The Main Principles Of Custom Private Equity Asset Managers

Wiki Article

The 3-Minute Rule for Custom Private Equity Asset Managers

(PE): investing in companies that are not openly traded. About $11 (https://soundcloud.com/cpequityamtx). There might be a few things you don't understand about the sector.

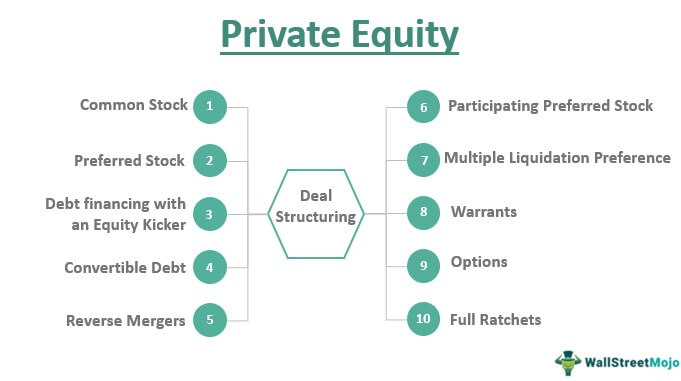

Private equity companies have a range of investment choices.

Because the finest gravitate toward the bigger deals, the center market is a dramatically underserved market. There are more sellers than there are extremely seasoned and well-positioned finance specialists with extensive customer networks and sources to handle a deal. The returns of personal equity are typically seen after a couple of years.

The 4-Minute Rule for Custom Private Equity Asset Managers

Flying below the radar of large international companies, much of these little companies usually provide higher-quality customer care and/or specific niche services and products that are not being supplied read by the large empires (https://www.evernote.com/shard/s663/sh/78f8afd3-421c-a28b-04f9-3d6f5b83621f/ome7lGPiSzHoRYJQyAoDvVbVWfkAw8Jt2BLyZOMkla8rOCrlw9A55i4ORg). Such benefits draw in the interest of exclusive equity firms, as they have the insights and smart to exploit such possibilities and take the firm to the following degree

Personal equity financiers should have reputable, qualified, and reputable management in position. Most supervisors at portfolio companies are provided equity and reward compensation structures that award them for striking their monetary targets. Such alignment of objectives is normally required prior to a bargain gets done. Exclusive equity opportunities are frequently unreachable for individuals that can't invest countless dollars, however they should not be.

There are guidelines, such as limits on the aggregate quantity of money and on the number of non-accredited financiers (Private Investment Opportunities).

The Main Principles Of Custom Private Equity Asset Managers

An additional negative aspect is the lack of liquidity; once in a personal equity transaction, it is not simple to obtain out of or sell. With funds under administration currently in the trillions, personal equity firms have become attractive financial investment cars for wealthy individuals and establishments.

For years, the characteristics of personal equity have made the possession class an appealing suggestion for those that might participate. Currently that access to exclusive equity is opening as much as more private investors, the untapped potential is becoming a reality. The inquiry to think about is: why should you invest? We'll begin with the main debates for purchasing personal equity: Just how and why personal equity returns have actually historically been more than other properties on a number of levels, How consisting of exclusive equity in a profile influences the risk-return profile, by aiding to expand against market and cyclical risk, Then, we will certainly outline some vital factors to consider and threats for exclusive equity capitalists.

When it pertains to introducing a new asset right into a profile, the most basic factor to consider is the risk-return account of that property. Historically, private equity has actually shown returns similar to that of Arising Market Equities and higher than all various other traditional possession classes. Its reasonably low volatility paired with its high returns creates an engaging risk-return profile.

The Definitive Guide for Custom Private Equity Asset Managers

Personal equity fund quartiles have the widest range of returns across all alternative property classes - as you can see below. Approach: Interior price of return (IRR) spreads computed for funds within classic years individually and afterwards averaged out. Average IRR was determined bytaking the average of the typical IRR for funds within each vintage year.

The effect of adding personal equity right into a portfolio is - as constantly - dependent on the profile itself. A Pantheon study from 2015 recommended that including exclusive equity in a profile of pure public equity can unlock 3.

On the various other hand, the very best private equity companies have accessibility to an also bigger pool of unidentified opportunities that do not face the very same examination, along with the sources to carry out due diligence on them and identify which deserve buying (Syndicated Private Equity Opportunities). Investing at the ground floor means higher danger, however, for the business that do succeed, the fund take advantage of higher returns

Fascination About Custom Private Equity Asset Managers

Both public and personal equity fund supervisors dedicate to spending a percent of the fund yet there continues to be a well-trodden problem with aligning passions for public equity fund management: the 'principal-agent trouble'. When a capitalist (the 'primary') hires a public fund supervisor to take control of their funding (as an 'representative') they entrust control to the manager while keeping ownership of the properties.

In the situation of personal equity, the General Companion does not just earn a monitoring cost. Private equity funds also mitigate an additional kind of principal-agent problem.

A public equity investor eventually wants one point - for the administration to raise the stock rate and/or pay out dividends. The financier has little to no control over the choice. We revealed above the amount of private equity techniques - particularly bulk acquistions - take control of the running of the business, making sure that the long-term worth of the company comes initially, raising the return on financial investment over the life of the fund.

Report this wiki page